The DAX MoneyControl index is one of the most critical financial barometers for the European economy, reflecting the performance of the 30 largest companies listed on the Frankfurt Stock Exchange. As Germany’s premier stock index, it offers critical insights into the country’s economic health and provides an early indicator for broader market trends across Europe. For investors, traders, and economists, keeping an eye on the DAX is essential for understanding market movements, as it is a leading gauge of domestic and global economic performance.

MoneyControl, one of the most respected financial platforms, provides regular updates on the DAX MoneyControl index, offering critical technical analysis, market insights, and expert commentary. With global economic uncertainty and changes in monetary policy continuing to influence markets, the DAX MoneyControl has experienced a series of fluctuations throughout 2024, creating new opportunities and challenges for investors. In this article, we’ll dive into the latest trends and performance metrics for the DAX MoneyControl index as of November 2024, analyzing the factors driving its movements and offering a forward-looking perspective on its outlook.

Understanding the DAX Index: A Key Player in Global Markets

The DAX MoneyControl index, short for Deutscher Aktienindex, is a price-weighted stock market index composed of 30 major German companies that are leaders in their respective sectors. These include industry giants such as Volkswagen, SAP, Bayer, Allianz, and Siemens. The DAX MoneyControl index is often seen as a reflection of the strength of the German economy, the largest in Europe, and a bellwether for global economic conditions.

The DAX MoneyControl index is considered a blue-chip index, as it tracks companies with significant global reach and strong financial standing. Unlike other indices, such as the S&P 500, which is weighted by market capitalization, the DAX MoneyControl index is weighted by share price. As a result, movements in the cost of high-value stocks, such as Volkswagen and SAP, can disproportionately affect the index’s overall performance.

For investors, understanding the DAX MoneyControl index is not just about knowing which companies are included in the index but also the factors that influence its performance. These consist of domestic economic data, geopolitical events, global trade conditions, and broader investor sentiment. Since the DAX MoneyControl index represents companies with a worldwide footprint, international developments—particularly in the U.S., China, and other major economies—also play a crucial role in shaping its performance.

Key Trends Impacting the DAX in November 2024

As we move through November 2024, several key trends are influencing the DAX MoneyControl index, providing challenges and opportunities for market participants. These include global economic uncertainty, rising inflation and interest rates, the resilience of the technology sector, and Germany’s push for sustainability and energy transition. Let’s

break these down further.

1. Global Economic Uncertainty and Its Impact on the DAX

Economic uncertainty remains one of the most dominant factors affecting the DAX MoneyControl index in late 2024. Over the past few years, the world has faced numerous challenges, from the ongoing COVID-19 pandemic to geopolitical tensions and trade disruptions. These global issues have had ripple effects on European markets, including the DAX MoneyControl.

While the European Union has managed to bounce back from the worst of the pandemic, the lingering effects of supply chain disruptions, labour shortages, and rising energy costs are still causing strain on both businesses and consumers. Moreover, with the war in Ukraine continuing to create political and economic uncertainty in Europe, DAX MoneyControl remains sensitive to these developments. Rising energy prices, in particular, have disproportionately affected European economies, making German industrial companies more vulnerable.

For instance, companies in the automotive and manufacturing sectors, which dominate the DAX MoneyControl index, have faced rising raw material costs and supply chain delays, which could lower their margins. As a significant exporter, any global slowdown could lead to weaker demand for German goods, further impacting the DAX MoneyControl.

2. Rising Inflation and the European Central Bank’s Response

Another critical factor impacting the DAX MoneyControl index is inflation and the European Central Bank’s (ECB) monetary policy. Like many central banks around the world, the ECB has raised interest rates throughout 2024 to combat persistent inflationary pressures. While the ECB’s decision to hike rates aims to cool off an overheating economy, it has benefits and drawbacks for the DAX MoneyControl.

On the positive side, higher interest rates can strengthen the euro, benefiting German exporters by making their goods cheaper for foreign buyers. However, the negative impact of rising interest rates cannot be overlooked. Higher borrowing costs typically lead to reduced consumer spending and business investment, which could result in slower growth for the companies within the DAX MoneyControl. This is particularly important for capital-intensive industries such as automotive manufacturing, where financing costs significantly influence business expansion.

Moreover, rising rates can dampen market sentiment, making investors more risk-averse. This means investors may shy away from equities in favour of safer, more stable assets like government bonds. This shift in investor behaviour can lead to increased volatility in the DAX MoneyControl index, as equities face headwinds from economic policy changes and investor sentiment.

3. Resilience of the Technology Sector

Despite the challenges the broader economy faces, the technology sector has remained a bright spot for the DAX MoneyControl index in 2024. As companies continue to digitalize their operations and rely more on technology, firms like SAP, Siemens, and Infineon Technologies have benefited from increased demand for cloud computing, automation, and digital transformation solutions.

The German software giant SAP has seen steady growth due to its enterprise resource planning (ERP) solutions, which are critical for businesses across all sectors. Similarly, Siemens has expanded its focus on automation, electrification, and digital industries, positioning itself as a leader in transitioning to more efficient, technology-driven economies. Infineon Technologies, a semiconductor manufacturer, has capitalized on the global chip shortage, seeing strong demand for its products used in everything from consumer electronics to electric vehicles.

As the technology sector grows, these companies are expected to remain strong drivers of the DAX MoneyControl index, providing some cushion against broader market declines. Investors are increasingly looking to technology companies for growth and stability, as these companies are less affected by the volatility that often impacts traditional industries like energy or manufacturing.

4. Sustainability and the Green Energy Transition

Germany’s ambitious goals to transition to a more sustainable energy future have also become a vital driver of the DAX MoneyControl index’s performance. Germany is investing heavily in renewable energy, electric vehicles, and green technologies as part of its commitment to the European Green Deal. DAX MoneyControl companies like Siemens Energy, RWE, and E.ON are at the forefront of this green transformation, and their performance is likely to continue benefiting from government policies designed to promote sustainability.

For example, Siemens Energy is involved in wind power projects, while RWE is expanding its renewable energy portfolio. E.ON, a utility company, focuses on clean energy solutions, including solar and wind, and is increasing its investments in electric vehicle infrastructure. As the world moves towards decarbonization, these companies are well-positioned to benefit from long-term growth trends in the green energy sector.

The transition to a more sustainable economy offers new growth opportunities for DAX MoneyControl-listed companies and helps them align with changing consumer preferences, regulatory requirements, and technological advancements. Investors, particularly those focused on ESG (environmental, social, and governance) criteria, are increasingly drawn to companies that prioritize sustainability.

Technical Analysis of the DAX in November 2024

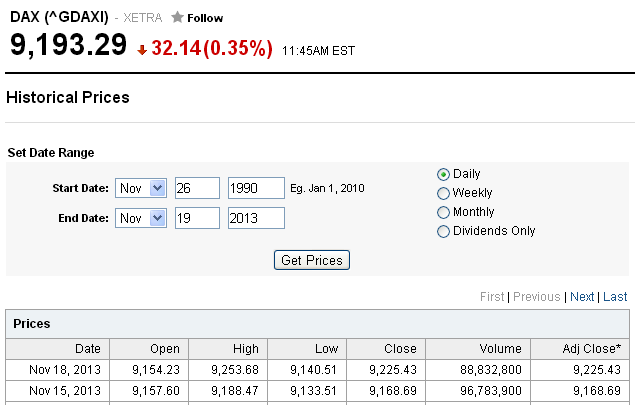

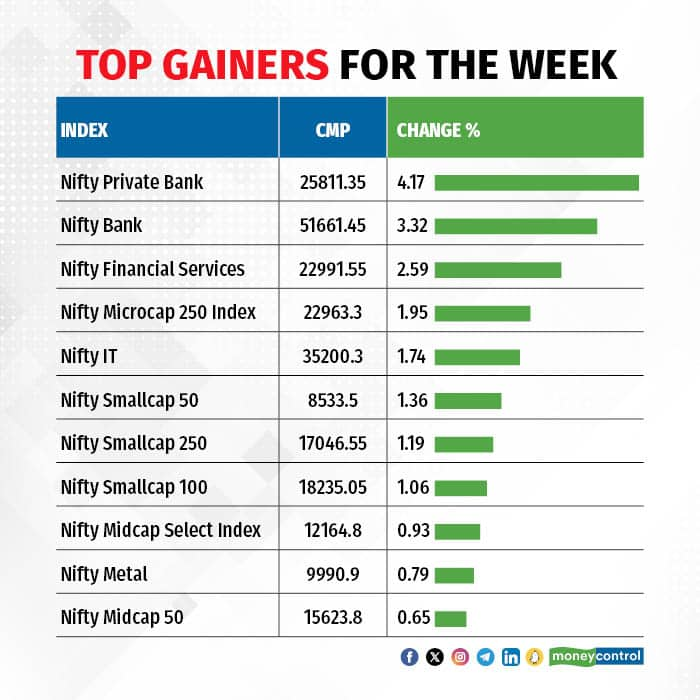

In addition to macroeconomic trends, the performance of the DAX MoneyControl index is also influenced by its technical indicators. MoneyControl’s detailed technical analysis of the DAX MoneyControl index in November 2024 provides investors with critical insights into the index’s behaviour.

1. Moving Averages and Trend Indicators

The DAX MoneyControl index’s overall trend remains bullish, with short-term moving averages above longer-term ones. As of November 2024, the 50-day simple moving average (SMA) is at 18,413.64, indicating positive momentum, while the 200-day SMA stands at 17,845.91, confirming the longer-term upward trend. This positive technical setup suggests that the DAX MoneyControl index could continue to rise if current trends hold.

2. Support and Resistance Levels

Key support levels for the DAX MoneyControl index in November 2024 are at 19,459.80 (S3), 19,500.00 (S2), and 19,557.17 (S1), while resistance levels are seen at 19,654.54 (R1), 19,694.74 (R2), and 19,751.91 (R3). These levels will be critical in determining whether the DAX MoneyControl index can break through key resistance and continue its bullish trajectory or if it will encounter downward pressure.

3. Technical Indicators: RSI and MACD

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are also helpful in gauging the DAX MoneyControl index’s momentum. A reading above 70 on the RSI suggests that the DAX MoneyControl index could be overbought, while a reading below 30 indicates it might be oversold. Similarly, a positive MACD crossover suggests that upward momentum could continue, while a negative crossover may indicate a reversal.

Conclusion: What to Expect for the DAX in the Coming Months

As of November 2024, the DAX MoneyControl index remains in a bullish phase despite the challenges posed by inflation, interest rate hikes, and global economic uncertainties. With soperformancences in the technology and sustasustainability sector andhwithnerally positive long-term outlook for the German economy, the DAX MoneyControl index is well-positioned to continue its upward trend in the months ahead.

However, investors should be cautious of potential volatility, particularly as central banks continue to fight inflation and geopolitical tensions remain a threat. The DAX MoneyControl index’s performance in the coming months will likely depend on various factors, including monetary policy decisions, economic data, and the ongoing green energy transition.

In summary, the DAX MoneyControl index offers plenty of opportunities for investors attuned to macroeconomic trends and technical indicators. A balanced approach—incorporating both short-term technical analysis and long-term fundamental insights—will be key to navigating the markets in November 2024 and b for those looking to invest in the indexed.

DAX MoneyControl Analysis FAQ

1. What is the DAX index?

The DAX index tracks the performance of Germany’s 30 largest publicly traded companies. It is widely regarded as a key indicator of the German economy and is frequently analyzed on platforms like MoneyControl for insights into market movements and trends.

2. How does MoneyControl provide insights into the DAX?

MoneyControl provides in-depth analysis of the DAX index, offering real-time data, technical analysis, performance charts, and expert opinions to help investors understand the current trends and make informed decisions.

3. What are the key factors affecting the DAX in November 2024?

The DAX in November 2024 is influenced by global economic conditions, rising inflation, changes in interest rates by the European Central Bank, and strong performances from the technology and green energy sectors, all of which are covered in MoneyControl’s analysis.

4. How accurate are MoneyControl’s DAX predictions?

While MoneyControl provides valuable insights and technical analysis, it’s important to remember that stock market predictions are never guaranteed. Based on historical data and current trends, their analysis helps investors make educated decisions, but market conditions can still change unexpectedly.

5. How can I access the latest DAX updates on MoneyControl?

You can visit the MoneyControl website or download their app for live updates, daily market performance, and comprehensive analysis of the DAX index. They also offer advanced charts and technical indicators to track real-time movements.

Leave a Reply