Introduction: The Intersection of Politics, Media, and Investment

The stock market has long been a space where economic fundamentals and market sentiment collide, creating opportunities for risk-takers and investors alike. However, when political figures become involved in the equation, the volatility can often increase significantly. One prime example of this is Trump Media & Technology Group (TMTG), a media company launched by former President Donald Trump with ambitious goals to challenge established social media platforms like Twitter, Facebook, and YouTube. TMTG, through its flagship platform Truth Social, aims to create a space for free speech, particularly for conservatives who believe mainstream social media has censored their voices.

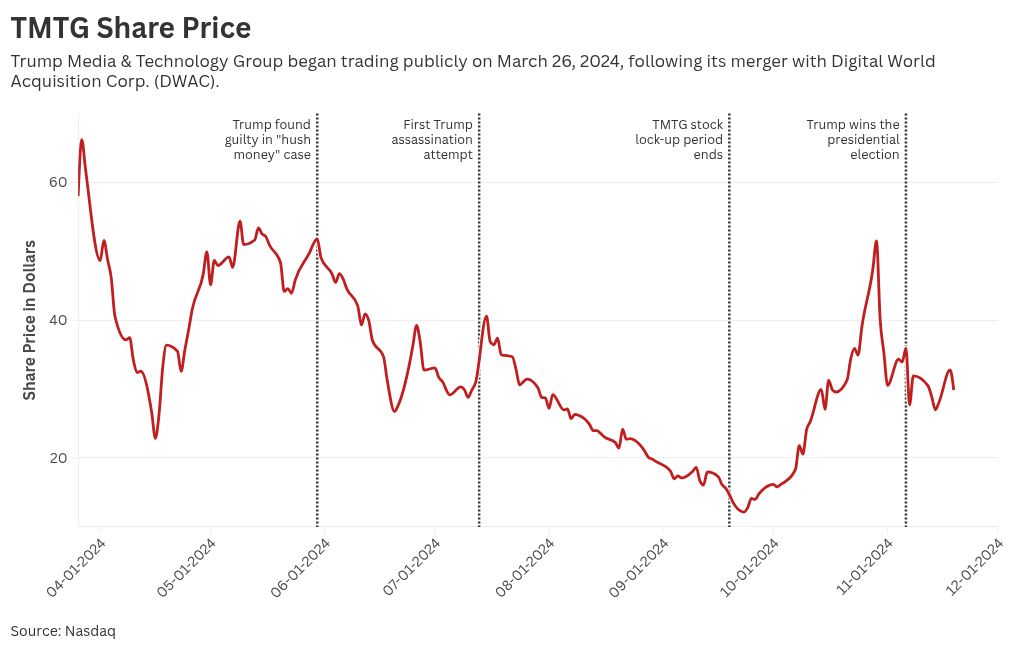

Since its inception, TMTG has experienced significant fluctuations in its stock price, often driven by the unpredictable nature of both Trump’s political career and the media landscape. For investors, the question is simple but challenging: will TMTG stock ever stabilize, or is it destined to be an asset that rides the wave of political and media uncertainty?

This article delves into the factors influencing TMTG’s stock movements, the risks and rewards associated with the company, and whether the stock will eventually find a stable footing in a media environment that is continually shifting.

The Launch of Trump Media & Technology Group

TMTG’s journey began in 2021, shortly after Donald Trump’s ban from major social media platforms like Twitter and Facebook. With Trump’s massive online following, his absence from these platforms left a significant void. For years, Trump had used social media, particularly Twitter, as his primary communication tool, using it to speak directly to his supporters, express political opinions, and even influence policy discussions. However, after the events of January 6, 2021, Trump was permanently banned from Twitter, Facebook, and Instagram, citing concerns over inciting violence and spreading misinformation.

This ban served as the catalyst for Trump’s decision to create his own platform. In late 2021, TMTG was formally launched with the goal of offering an alternative to Big Tech. The company’s flagship platform, Truth Social, was intended to provide a space for free speech, where users could express themselves without fear of censorship. For Trump’s supporters, many of whom believed that conservative voices were being unfairly silenced on mainstream platforms, Truth Social promised to be a breath of fresh air.

To fund TMTG’s growth and go public, the company merged with Digital World Acquisition Corp. (DWAC), a Special Purpose Acquisition Company (SPAC). A SPAC is a shell company that raises money to acquire or merge with an existing company. In the case of TMTG, this deal allowed the company to enter the public markets without going through a traditional Initial Public Offering (IPO). The SPAC merger drew significant attention, with many investors hoping to cash in on the future of a Trump-led media empire.

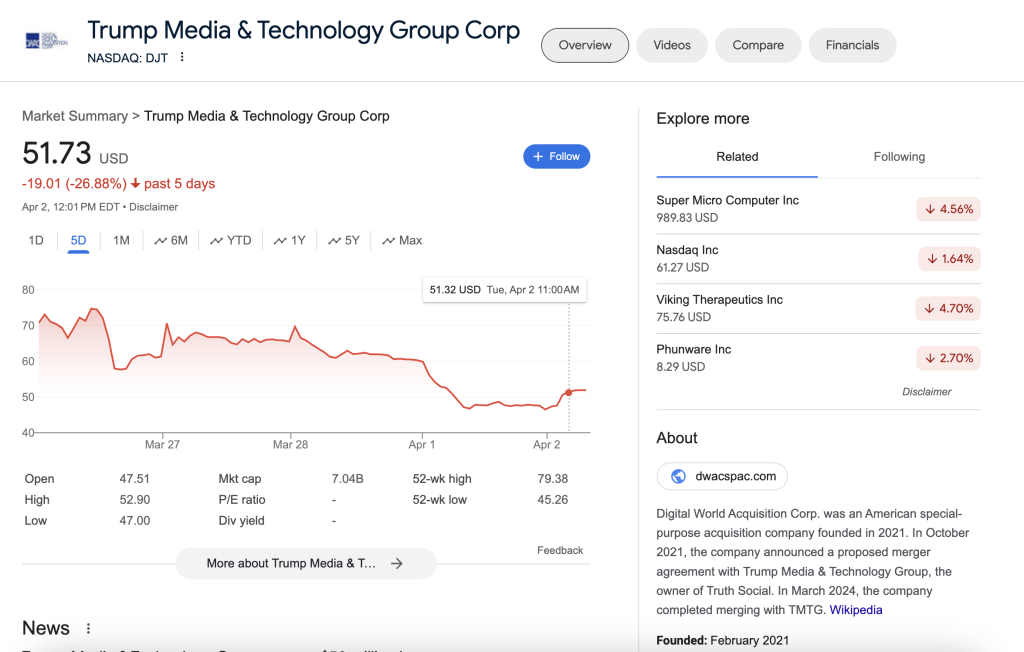

TMTG’s stock began trading under the ticker symbol “TMTG” after the merger, and initially, it was met with enthusiasm. The excitement was palpable, particularly among Trump’s loyal supporters who saw the stock as a way to invest in the political future of their icon. The initial rise in the stock price was fueled by hope and speculation about the success of Truth Social and TMTG’s potential to disrupt the tech world.

Stock Volatility: Factors Driving Fluctuations

While TMTG’s stock initially saw significant gains, it has also experienced sharp declines, leaving investors to question whether the company can stabilize. Several key factors have contributed to the volatility of TMTG stock, many of which are tied directly to the political and media landscape that surrounds Trump.

1. Trump’s Political Influence and Public Image

One of the biggest drivers of TMTG’s stock fluctuations is Donald Trump himself. As a highly polarizing figure, Trump’s actions have the ability to move markets — both positively and negatively. In the case of TMTG, this is particularly true. For example, any major political move or public statement by Trump can directly impact investor sentiment. If Trump makes headlines for a controversial speech, legal battles, or even his potential candidacy in upcoming elections, the stock can experience significant swings.

This direct correlation between Trump’s actions and TMTG’s stock price is both a boon and a curse for investors. On the one hand, Trump’s loyal base of supporters and media coverage can propel the stock higher. On the other hand, his involvement in political scandals, ongoing investigations, or even negative media coverage can drive the stock price down just as quickly. Essentially, TMTG’s stock is inextricably tied to the fate of Trump himself.

2. Challenges in Growing User Base and Engagement

While Truth Social has gained a following among Trump supporters and conservatives, it faces significant challenges in competing with established platforms like Twitter, Facebook, and YouTube. These platforms have billions of active users and deeply ingrained advertising ecosystems. Truth Social, on the other hand, launched in a highly competitive market, and its ability to attract new users has been slower than expected.

This is a critical issue for TMTG, as a growing user base is essential for generating revenue, particularly through advertising. Without the scale necessary to attract advertisers, Truth Social may struggle to become profitable. Furthermore, the platform must deal with the complex and evolving issue of content moderation, which can be a challenge when dealing with a user base that is passionate and politically charged. Failure to manage content and maintain user engagement could lead to a stagnating platform, which in turn could drag TMTG’s stock price down.

3. Insider Trading and Financial Instability

Another factor contributing to TMTG’s stock volatility is insider trading and the company’s financial instability. Reports have surfaced regarding TMTG executives and insiders selling large amounts of stock, which raises concerns about the company’s future. In general, when key insiders sell their stock, it can signal a lack of confidence in the company’s prospects and lead to wider sell-offs.

Additionally, TMTG’s financial condition has been precarious at times. The company has struggled to secure the necessary capital to expand its operations and effectively compete with larger media companies. Without sufficient funding, TMTG could face difficulties in scaling its platforms or investing in new technologies. These financial struggles can also contribute to the stock’s volatility, as investors become nervous about the company’s ability to sustain itself in the long term.

4. Legal Challenges and Regulatory Risks

TMTG has also faced legal challenges and regulatory scrutiny that have impacted its stock price. The company has been the subject of various investigations, including concerns over its SPAC merger with DWAC. SPAC deals have been under heightened scrutiny by regulators, and TMTG’s deal is no exception. If the company faces legal or regulatory setbacks, this could negatively impact its ability to raise capital or maintain a public listing, which would have a direct effect on its stock price.

Furthermore, TMTG’s positioning as a conservative alternative to mainstream tech platforms puts it in a vulnerable spot when it comes to regulation. With increasing pressure from governments around the world to regulate content on social media platforms, TMTG may face legal hurdles related to free speech, misinformation, or even privacy concerns. These challenges add another layer of uncertainty to the company’s future and contribute to the volatility of its stock.

Can TMTG Stock Stabilize?

Given the factors outlined above, the question on many investors’ minds is whether TMTG stock will ever stabilize. The reality is that the volatility surrounding the company is not likely to dissipate anytime soon. TMTG’s stock will continue to be impacted by a combination of political events, market sentiment, and the success or failure of its platforms.

That being said, there are several potential catalysts that could help stabilize the stock in the future:

1. A Successful Trump Comeback in Politics

If Trump decides to run for office again in 2024 or beyond, it could provide a boost to TMTG’s stock. A political comeback would likely reignite investor enthusiasm in the company, especially if Truth Social becomes a key tool in Trump’s campaign strategy. The stock could experience significant rallies in the lead-up to an election, as Trump’s presence in the political landscape tends to generate media buzz and excitement among his supporters.

2. Increased User Adoption and Revenue Generation

For TMTG’s stock to stabilize, Truth Social and other platforms in its portfolio will need to attract more users and generate consistent revenue. If TMTG can successfully carve out a niche in the social media market and become a profitable company, the stock may find a more stable price point. This would require TMTG to improve its platform, increase user engagement, and build a sustainable advertising model.

3. Strategic Partnerships or Acquisitions

A potential strategy for TMTG to stabilize its stock could involve forming strategic partnerships or acquiring other companies that complement its media portfolio. By integrating new technologies or platforms, TMTG could increase its appeal to both users and investors. A successful partnership could inject fresh capital and create new opportunities for growth, leading to more stability in the stock.

Conclusion: A High-Risk, High-Reward Investment

The fluctuating stock price of TMTG reflects the uncertainty surrounding the company’s future. With its ties to Donald Trump, the political landscape, and a competitive media market, TMTG’s stock is subject to significant swings. While this offers opportunities for investors looking to capitalize on volatility, it also presents a high level of risk.

For those who believe in Trump’s ability to influence the media and political spheres, TMTG could represent a high-reward investment, particularly if the company can gain a solid foothold in the social media market. However, for more risk-averse investors, the volatility surrounding TMTG may be too unpredictable to warrant a long-term investment.

Ultimately, whether TMTG stock stabilizes will depend on a combination of factors, including Trump’s political career, the company’s ability to grow its platforms, and its financial health. For now, it remains a speculative play, one that could either soar or sink depending on the next set of political and business developments.

Frequently Asked Questions (FAQs) About TMTG Stock

1. What is TMTG stock?

TMTG stock refers to shares of Trump Media & Technology Group (TMTG), a media company founded by former U.S. President Donald Trump. TMTG is the parent company of Truth Social, a social media platform designed as an alternative to mainstream platforms like Twitter and Facebook. The company went public through a merger with Digital World Acquisition Corp. (DWAC), a Special Purpose Acquisition Company (SPAC), and its shares trade under the ticker TMTG.

2. Why is TMTG stock so volatile?

TMTG stock has experienced significant volatility due to several factors, including:

- Trump’s political influence: The company’s stock price is closely tied to the actions and public presence of Donald Trump. Political events, legal challenges, or Trump’s involvement in elections can cause fluctuations.

- User adoption challenges: Truth Social, the company’s flagship platform, has struggled to compete with established social media giants like Facebook and Twitter, which can impact investor confidence.

- Financial instability: TMTG has faced difficulties in securing capital and growing its revenue streams, contributing to stock price volatility.

- Insider trading and leadership changes: Sales of stock by insiders or changes in management have raised concerns among investors.

3. Can TMTG stock stabilize in the future?

The future stability of TMTG stock depends on several factors, including:

- Trump’s political career: If Trump runs for office again or plays a prominent role in politics, it could boost investor interest in TMTG and provide a potential catalyst for stock growth.

- Growth of Truth Social: If Truth Social can attract a larger user base and become profitable, it could help stabilize the company’s stock.

- Strategic partnerships: Collaborations or acquisitions that strengthen TMTG’s media offerings could positively impact its financial performance and stock stability.

However, given the company’s reliance on political dynamics and its position in a competitive media market, TMTG stock is expected to remain volatile for the time being.

4. How can I buy TMTG stock?

TMTG stock can be purchased through any brokerage account that offers trading in U.S. securities. You can buy shares of TMTG through online trading platforms or through traditional brokerage firms. Keep in mind that TMTG stock is traded via a SPAC merger with DWAC (Digital World Acquisition Corp.), and investors should be aware of the potential risks associated with SPAC investments.

5. Is TMTG stock a good investment?

Whether TMTG stock is a good investment depends on your risk tolerance and investment goals. The stock has shown strong volatility, which presents both risks and potential rewards. If you believe in the long-term potential of Trump’s media platform and his ability to influence the market, TMTG might offer growth opportunities. However, due to the political and financial uncertainties surrounding the company, it may not be suitable for risk-averse investors.

6. What factors affect the price of TMTG stock?

The price of TMTG stock is influenced by several factors:

- Political developments: News related to Trump’s political career, public statements, and legal challenges can have an immediate impact on the stock price.

- Company performance: The financial health of TMTG, including its ability to grow Truth Social and generate revenue, plays a crucial role in stock fluctuations.

- Market sentiment: Broader market trends, investor sentiment, and news related to other tech companies or media platforms can affect TMTG’s stock price.

- Regulatory challenges: As a media company, TMTG faces scrutiny and potential regulation, which can influence its operations and market perception.

7. Why did TMTG merge with a SPAC?

TMTG merged with Digital World Acquisition Corp. (DWAC), a SPAC, to go public. SPACs offer a quicker and less complex alternative to traditional Initial Public Offerings (IPOs), which is why TMTG chose this route. By merging with DWAC, TMTG was able to access public capital markets without going through the typical IPO process. However, SPAC deals are often subject to regulatory scrutiny, which has contributed to some of the stock’s volatility.

8. What is Truth Social and how does it relate to TMTG stock?

Truth Social is the flagship social media platform of Trump Media & Technology Group (TMTG), created as an alternative to platforms like Twitter and Facebook. The platform has gained popularity among Trump’s supporters and conservatives who feel their voices are censored on mainstream platforms. The performance and growth of Truth Social directly affect TMTG’s financial success and stock price. If Truth Social gains more users and advertisers, it could boost TMTG’s revenue, helping stabilize the stock.

9. How has the stock price of TMTG performed since its IPO?

Since TMTG went public via a SPAC merger in 2021, its stock price has been highly volatile. Initially, there was significant excitement surrounding the platform’s launch, causing the stock to surge. However, the stock has also seen sharp declines, particularly as investors raised concerns about Truth Social’s growth prospects, regulatory hurdles, and competition from established social media platforms.

The volatility has been further exacerbated by political events and insider sales of stock by TMTG executives. Overall, the stock’s performance has reflected both speculative optimism and caution as the company navigates the challenges of scaling a new media platform.

10. What are the risks of investing in TMTG stock?

Investing in TMTG stock carries several risks, including:

- Political instability: Since TMTG is tied to Trump, any political developments, legal issues, or controversies surrounding him could lead to rapid fluctuations in the stock price.

- Platform challenges: Truth Social and other TMTG platforms must compete with tech giants like Twitter and Facebook, and failure to attract users or generate revenue could hurt the stock.

- Regulatory scrutiny: As a media company, TMTG faces the risk of increased regulation, which could impact its ability to grow and operate freely.

- Financial instability: The company’s reliance on SPAC funding and its struggles to raise capital could present significant financial risks.

Investors should carefully consider these risks and conduct thorough research before purchasing TMTG stock.

11. Can I expect dividends from TMTG stock?

Currently, TMTG does not pay dividends. The company is in its growth phase and likely reinvests any revenue into expanding its media platforms and operations. Investors in TMTG stock should not expect dividends in the near future but rather should focus on potential capital gains if the company’s stock price appreciates over time.

12. How does TMTG compare to other media stocks?

Compared to more established media companies, TMTG is still in its early stages and faces significant challenges. While companies like Meta (Facebook) and Twitter have vast user bases and robust advertising models, TMTG is competing with a new platform (Truth Social) that is still growing. The risks associated with political backing, user acquisition, and regulatory issues make TMTG a more speculative investment relative to traditional media stocks. However, if Truth Social finds success, TMTG could become a major player in the conservative media landscape.

Conclusion

TMTG stock is a high-risk, high-reward investment, driven largely by political developments, user growth on Truth Social, and the company’s ability to generate revenue. While the stock has fluctuated significantly since its public debut, its future remains uncertain, and investors should be prepared for continued volatility. As with any investment, it’s important to conduct thorough research and assess your risk tolerance before diving into the world of TMTG stock.

Leave a Reply